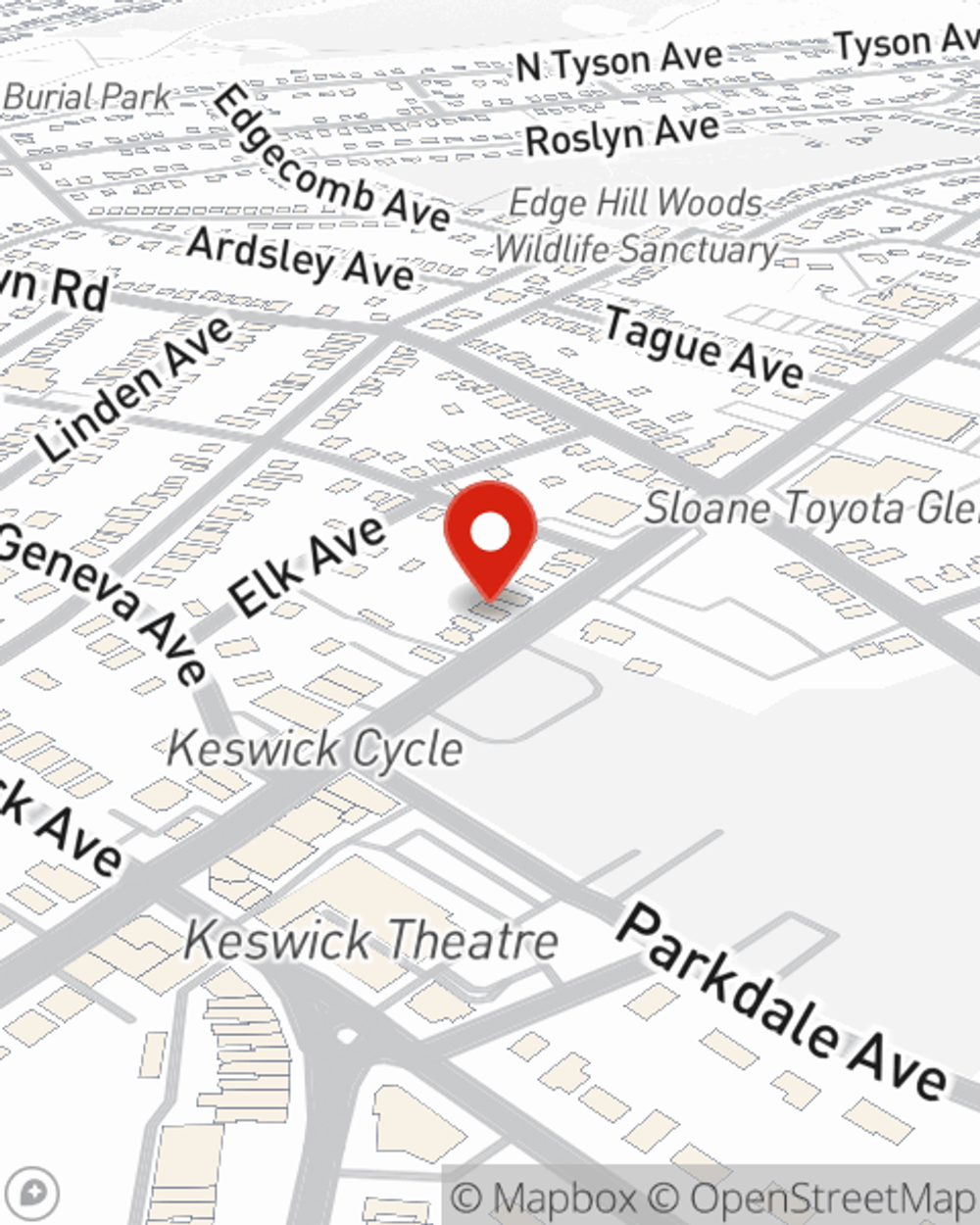

Business Insurance in and around Glenside

Searching for coverage for your business? Look no further than State Farm agent Gina Bennett!

Helping insure businesses can be the neighborly thing to do

Business Insurance At A Great Value!

You've put a lot of hard work into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's an art gallery, a toy store, a cosmetic store, or other.

Searching for coverage for your business? Look no further than State Farm agent Gina Bennett!

Helping insure businesses can be the neighborly thing to do

Customizable Coverage For Your Business

You are dedicated to your small business like State Farm is dedicated to dependable insurance. That's why it only makes sense to check out their coverage offerings for artisan and service contractors, worker’s compensation or commercial auto.

Let's review your business! Call Gina Bennett today to see why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Gina Bennett

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.